If you get HDFC Credit Card few you have to know procedures to manage it. Starting with registering it with HDFC NetBanking you can make payment and get loans with card. If any mis happening like credit card is lost or stolen occurs you have to block it. With credit card, you can get certain types of loans like cash on Call or dial an EMI and make payments. All these tasks can be done through online banking. To manage your Credit Card in HDFC bank, you have to follow few information and procedures. We are writing here all course of actions you can make to your card using internet banking for your account.

HDFC Credit Card Registration Through NetBanking

Firstly you have to register your Credit Card for HDFC NetBanking.

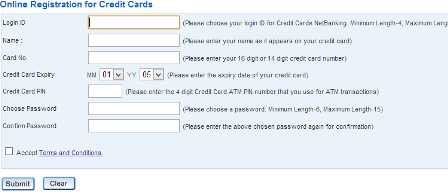

1. Firstly you have to complete the Registration form for registration of your HDFC Credit Card.

2. Fill up Login ID, Name, Card Number, Expiry date, PIN, and password and check the box against Accept Terms and Conditions and click on Submit button.

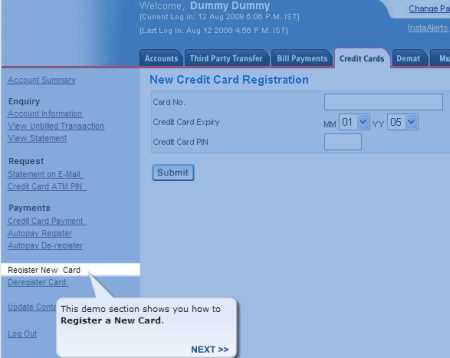

2.Now Login your NetBanking and go to your Credit Card tab, and click Register New Card in the left panel

Fill up Card Number, Expiry month and year, and PIN and Click on Submit Button. Your card will be successfully registered.

How to Block HDFC Credit Card through NetBanking

If you have lost HDFC Credit Card or it is stolen by someone then you have to block your Credit Card with HDFC Netbanking. And you can also be able to request to reissue a new credit card using the Hotlisting facility under the credit card NetBanking page. Hotlisting means if you have missed your card or thieved by someone then you have to inform the bank so that the bank may cancel it to protect from being used by other persons. Steps are given below to block your HDFC Credit Card.

1. Login into your NetBanking account, and choose the Hotlisting option under the Credit Card tab.

2. Thereafter decide on the card to be blocked from the drop down mentioning the reason i.e. Lost or Stolen.

3. You are also able to apply for the card to be re-issued (Yes or No) and click submit option.

You have to pay a charge of Rs.100/- for the service of blocking your HDFC Credit Card. The whole process for this service will take a time of 10 to 15 working days not in blocking your Credit Card but for re-issuing your Credit Card. Call the Customer Service number of HDFC Bank if your card is damaged or lost.

HDFC Cash on Call or Dial an EMI for Credit Card

These facilities are for avail Cash Loan within the eligible credit limit of HDFC Credit Card and HDFC Cash on Call and Dial an EMI allow you to convert your credit card purchases into EMI at attractive Interest rates. This facility is not for all customers but only for selected customers who come under bank’s policy. For this, you have to apply online or call to Phone banking helpline number. Steps for online applying for HDFC Cash on Call and Dial an EMI are given below.

1. Firstly Login to HDFC NetBanking and choose option Credit Card. And then go with Cash on Call option which has been provided on the left-hand side.

2. Choose the card and click on Continue.

3. Then enter the required loan amount, tenure, and Confirm.

You have not to offer more documents because this is an online process. The loan will be provided you up to between Rs.10000/- up to Rs.300000/-. Interest rate will vary according to your payment of tenure. The loan amount will be transferred to saving account within 48 hours (2 Days).

For this facility, you have to pay an amount of Rs.500/- plus service tax @ 12.36%. If you are applying through NetBanking additional 2% on the loan amount will be extra charged. Otherwise, you have to pay an amount Rs.500/- to Rs.2000/- plus service tax by another method.

For Dial an EMI, you have to follow same steps as mentioned above. You have to only replace the option of Cash on Call by Dial an EMI. This provides a loan of Rs.5000/- or above. You have to pay an amount of Rs.250/- plus service tax @ 12.36%. If you are applying through Net Banking additional 2% on the loan amount must be paid. Otherwise, you have to pay an amount Rs.250/- to Rs.1750/- plus service tax by another method. The loan amount will be transfer to your savings account within only 24 hours (1 Day).

HDFC Online Credit Card access Benefits

There are many benefits of accessing Online HDFC Credit Card for the users which have mentioned below in details.

a) View Account Information

b) Watch Unbilled Transactions

c) Watch Credit Card Statements (up to last 6 months)

d) Make Credit Card Payments

e) Auto pay Registration

f) Auto pay De-registration

g) Registration of New Card

h) De-registration of Card

i) Statement on E-MAIL-mail

j) Credit Card ATM Pin and many more.

You can see a demo of HDFC Credit card registration, blocking, etc through this demo: Demo